New Delhi, May 24: Prices of gold and silver, both considered safe investment bets, have seen a mild correction this week after the latest stellar bull run.

These declines of late are partly due to profit booking by investors, a relative weakness in the USD index (which is directly proportional to their prices), and an indication from the US central bank that it would reduce key interest rates later than was earlier expected.

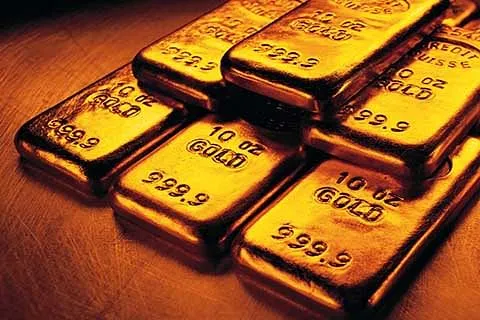

Gold has been in demand for a considerable period, with its prices rallying to hit record highs now and then. Geopolitical conflict in West Asia that stretched for a long time, buying by several central banks including RBI, and physical demand, have altogether pushed gold prices northwards.

Gold, and also silver, are scarce commodities, and any mismatch in demand-supply conditions may invariably trigger a sharp price rise.

According to the India Bullion and Jewellers Association (IBJA), the yellow metal this Tuesday traded at its all-time high at Rs 74,222 per 10 grams for the fine gold (999) quality. On Friday, it traded at Rs 71,950, marking a little over Rs 2,000 decline.

Benefiting from strong sales, organised gold jewellery retailers are set to clock 17-19 per cent revenue growth in the current financial year 2024-25, according to Crisil.

Similarly, for silver, prices declined nearly Rs 4,000 during this to a little over Rs 91,000.